Company B’s implementation of IFS Cloud and cost management reform

1. Company Overview and Challenges

Company B is a mid-sized process manufacturing company that produces and sells a wide variety of small quantities of industrial chemicals. Previously, cost calculations were performed using a rough allocation by department, which meant that the company was unable to grasp the exact cost of each product or the cost variance for each lot, preventing it from identifying low-profit products and implementing cost-cutting measures. Furthermore, the impact of fluctuations in raw material prices and energy costs on profits could not be immediately grasped, and the paper- and Excel-based management system created an information gap between the field and management.

2. IFS Implementation Background and Project Overview

The management decided to implement IFS Cloud, positioning “visualizing costs” and “improving profit margins” as their top priorities. The project covered all areas of sales, procurement, production, quality, and accounting, and was fully operational in approximately 12 months.

3. Key Points of Cost Management Reform

Subdivision of cost elements and creation of templates

Cost elements such as material costs, labor costs, machine costs, outsourcing costs, and other expenses can be created as templates and set in detail for each product and process. For example, even for the same “mixing” process, machine operating hours and work hours can be registered separately for products A and B, making it possible to calculate costs that are in line with reality.

BOM, recipe, and process-specific cost calculation

Multi-stage BOMs and recipe configurations specific to process manufacturing are registered in the IFS. Standard costs and actual costs are calculated on a lot-by-lot basis, reflecting the operating time and unit costs of input materials, workers, and machines for each process. This makes it easier to analyze the causes of cost variances.

Setting standard production volume and lot-by-lot cost management

Set a standard production volume for each product and automatically calculate fluctuations in the cost per unit by comparing it with the actual production volume. You can instantly grasp cost increases due to small lot sizes and poor yields.

4. Comments from the person in charge

Production Management Department Manager

“Before implementing IFS Cloud, cost calculations were very rough, and many people on the front lines were questioning whether the figures were accurate. After implementing it, costs were made visible for each process and lot, allowing the front lines and management to hold discussions based on the same figures. In particular, by clarifying the causes of cost variances, the speed of on-site improvements has increased dramatically.”

Manager of the Corporate Planning Department

“We can now quickly identify products with low profit margins and reflect these in our sales strategies and price revisions. The time required for cost calculations and report creation has also been significantly reduced, dramatically improving the speed at which we can make management decisions.”

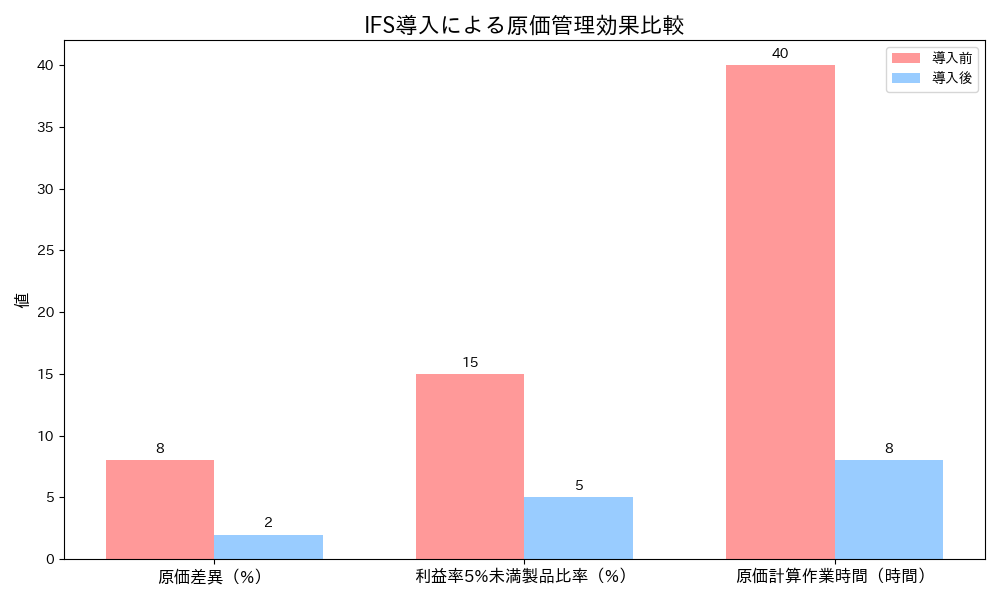

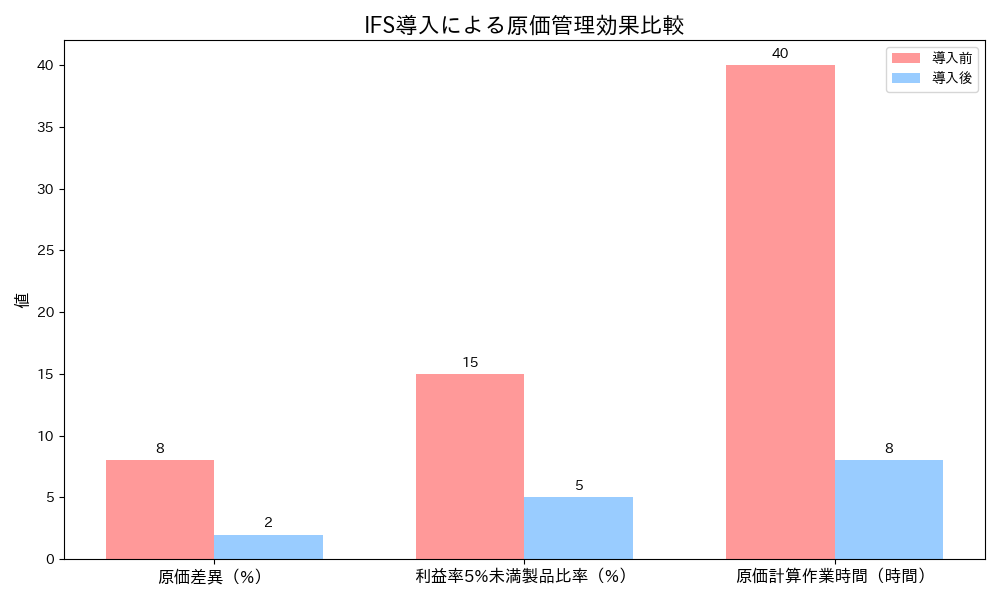

5. Benefits of Implementation

- Cost variance (difference between standard cost and actual cost): 8% → 2% (approximately 75% reduction)

- Proportion of products with a profit margin of less than 5%: 15% → 5%

- Cost calculation and analysis work time: 40 hours per month → 8 hours (80% reduction)

By implementing IFS Cloud, Company B was able to “visualize costs” and “maximize profit margins.” The company has established a system where the same data is shared in real time between the field and management, enabling them to quickly implement the PDCA cycle for cost reduction and profit margin improvement. Going forward, the company plans to utilize cost data to develop new products and optimize the entire supply chain.

inquiry

For inquiries regarding cost management, click here

.jpg)